The most innovative rental company

We founded Storent with the aim of offering our customers the possibility to rent equipment quickly, easily, without unnecessary bureaucracy and at the best possible price. To achieve this, we have focused on integrating IT solutions into our work from the very beginning and invested heavily in IT solutions from day one.

Now Storent's rental processes are automated to the maximum. We have developed an ERP system for the management of sales activities (integrated CRM), the organization and planning of repairs and maintenance, financial accounting and management, as well as all other business processes related to the operation of a construction equipment rental company.

In addition, digital solutions also play an important role in Storent's cooperation with the customer. Without calling or driving to us, a Storent customer can carry out all activities remotely: book, collect and hand over the required equipment

Our future consists of many components that we have combined in an IRMS (Intelligent Rental Management System) - it digitizes all our internal processes, some of them fully automated, significantly increasing efficiency as well as collaboration with our customers. And we plan to go even further by implementing Artificial Intelligence and Machine Learning wherever it's possible. A person will always remain the decisionmaker, but we intend to use every opportunity we have in the 21st century to pass the small time-consuming tasks to technologies.

Finance helps us grow faster - we are on a wave of innovation that is carrying us towards our development goals. The industry is changing, we know exactly what to do to take advantage of this situation for ourselves and the industry. By raising additional assets through bond emission, we will fulfil a number of strategic objectives, driving our business forward.

We will not stop there. We will go further.

Owner's message

Co-owner Andris Pavlovs

Company Highlights

STORENT, established in 2008, is the leading building equipment rental company in Latvia, taking up one of the biggest market shares in the Baltics and present in Sweden, Finland and the United States. STORENT operates 35 rental depots. Slogan RENTAL EQUIPMENT EXPERTS reflects who we want to be for our customers – experts in machinery and tools. We strive to provide customers means to perform their job within required timeframe and budget.

€ 47.2m

Consolidated revenue (2024)*

11%

Baltic market share

100%

Latvian capital

*Non-IFRS APM: results of operations before revaluation effects

€ 13.3m

Consolidated EBITDA (2024)*

#1

Leader in rental process digitalization and online sales

€ 140+m

Total rental fleet Company operates (2024 December)

€ 0.9m

Consolidated EBT (2024)*

32

Rental depots

(2025 May)

250

Employees

(2024 December)

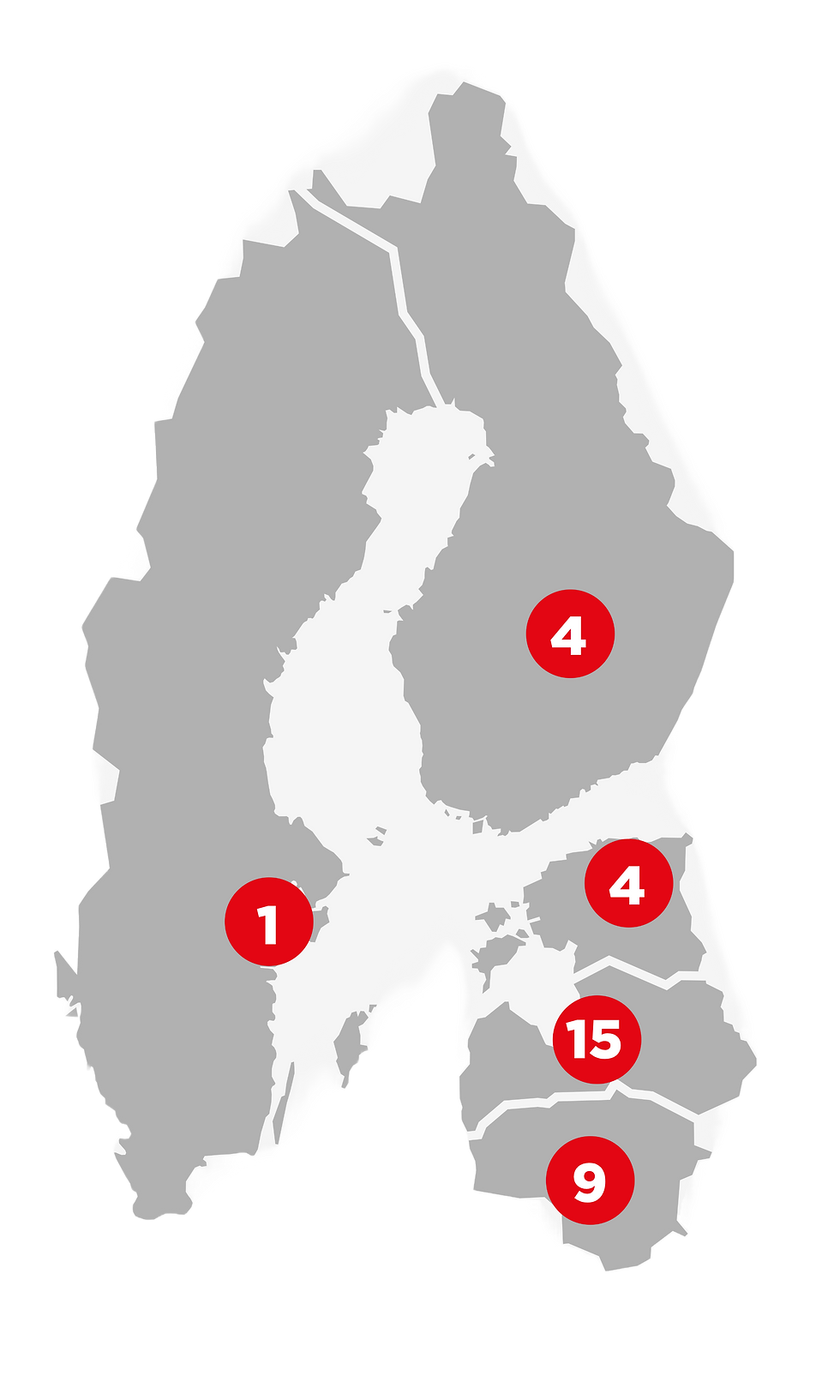

Geographic Summary

Share in 2024 consolidated Storent revenue

Number of Storent rental depots

Storent Key Numbers

€63.0m

Revenue*

€22.6m

EBITDA*

€5.4m

EBT*

#1

Leader in rental process digitalization and online sales

35

Rental centers

€150m+

Storent equipment fleet at initial purchase prices

100%

Latvian capital

275

Employees

Where We Operate

.png)

Europe

.png)

LATVIA

Lithuania

Since 2008

Estonia

Since 2009

Finland

Acquired in 2016

Sweden

Operated since 2017

Our Journey

Why Trust Us?

Proven Growth

Storent has doubled its value and expanded across Europe and the U.S. — strong results, clear direction.

Digital Leader

Pioneer in rental process digitalization and automation, driving efficiency and scalability in every market.

Market Power

Ranked No. 1 in Latvia and No. 3 in the Baltics, with a growing niche presence in the Nordics and a strategic expansion into the U.S. market.

Investor Confidence

Backed by ~5 000 investors from 17 countries, Storent stands for transparency, reliable returns, and proven leadership.

Why Trust Us?

Steady Growth

Well-established, growing company

EUR 0.9 million profit before tax in 2024

Future Tech

Leader in rental process digitalization and online sales

Fully automatized company's internal processes

Global Company

Investors from 25 countries

Around 4000 investors have already purchased company's bonds

Market Leaders

Strong Baltic market position

#1 in Latvia, #3 in Estonia and Lithuania, growing presence in Finland and Sweden markets

Our Vision

Our Purpose

MISSION

At STORENT, we are redefining the rental industry through innovation and expertise. Our team of rental equipment specialists delivers cutting-edge solutions that maximize efficiency, flexibility, and sustainability for our customers.

VISION

To be the most innovative rental company in the world, powered by a team of experts who set new industry standards through smart technology, exceptional service, and sustainable solutions.

CUSTOMER PROMISE

We are always available and committed to take care of our customers and partners.

Our Must-Win Battles

SEEK KNOWLEDGE

Equipment rental experts who are always seeking innovation.

ENJOY THE RIDE

A strong and united team – we work together, and we have fun together.

BE IN CHARGE

Take responsibility to achieve goals and be the customer's first choice.

KEEP MOVING

Continuously strive for clear, efficient, and modern processes.

Innovations - the Digitalisation Story

We at Storent have focused on integrating IT solutions into our work from the very beginning and invested heavily in IT solutions from day one. During these years, we have achieved remarkable progress in streamlining our internal work organization and collaboration with clients.

-

Automated accounting and management reports

-

Profit and loss statement for each equipment unit (drill, lifts)

-

Every management decision based on data using advanced BI tools

Financial Management

-

Automated technician workflow

-

Automated processes of maintenance and repairing

-

Technicians using devices to keep track of task progress

Technical Division

-

Delivery and return using QR code

-

Organizing the logistics using CargoPoint

Customer Service Management

-

Automated customer onboarding with credit rating check

-

Digital signing of agreements, delivery notes

-

Automated reservations from availability reports to equipment delivery

-

Automated invoicing and income forecasting

-

Integrated equipment sharing through Preferent

-

Integrated CRM module

Sales management

All internal business processes are automatized to the maximum. Working 100% paperless.

Innovations will not stop at what we have achieved now. We have set a goal to implement Artificial Intelligence and Machine Learning wherever possible to raise our efficiency to an even higher level.

Innovations will not stop at what we have achieved now. We have set a goal to implement Artificial Intelligence and Machine Learning wherever possible to raise our efficiency to an even higher level.

Frequently Asked Questions

Storent provides rental equipment solutions. We have over 20 product groups. Main rental equipment groups are aerial lifts and working platforms, telescopic handlers and forklifts and earthmoving equipment.

More about our services find on our site: Storent.comFirst advantage: this company was founded to implement digitization in the rental industry. We have embraced innovations since day one and strongly believe that working digitally is vital to the growth of our company and industry overall. Seeing the potential of digitalization so early gives us a great advantage in the industry.

The second advantage: our team consists of experts. Constantly seeking knowledge is one of our core values and employees are motivated to constantly extend their knowledge. Furthermore, management has extended experience in the equipment rental industry (20+ years) which gives the advantage of knowledge-based decision-making.

Our clients are in the form of B2B and B2C.

Business clients are mostly construction companies (construction, renovations, road infrastructure works), manufacturers, event organizers, farmers, and the military.

Private clients need equipment to do small projects, for example, renovations at home, maintenance projects.

Storent aims to strengthen its market positions in the Baltics as well as continue expansion in Sweden and Finland. The company is continuing to work on its sales efficiency and digitization efforts, maximizing its online rental experience.

See our latest and historical financial results in section “Financials”.

There are two options how to invest in Storent bonds:

1) During the initial offering if the offer is available in the investor's country.

2) By placing a purchase order on the Nasdaq Baltic Bond List through one of its members.

Yes, investors can join our exclusive loyalty program, which offers a 25% discount on rental transactions. To take advantage of this offer, simply reach out to us via email at investor.relations@storent.com

Subscribe to our newsletter (see form lower) and be the first to know about future bond emissions and other news.

EMISIJOS DUOMENYS